This article was originally written and published by ASX, member of BlockchainNZ. For information on ASX find the original article here.

While it’s been some years since Distributed Ledger Technology (DLT) emerged as the next generation of digital innovation, vast improvements to this technology have seen its importance and popularity surge exponentially.

This revolutionary alternative to traditional centralised database technology has helped organisations realise significant benefits including speed, transparency, risk management and operational efficiency.

Until recently, organisations have been able to access elements of DLT, such as “Ledger as a Service” or specific smart contract solutions, from specialist providers. However, a comprehensive “DLT as a Service” offering enabling users to build applications leveraging third party DLT infrastructure, has been more elusive.

Like most “as a Service” offerings, the use of DLT as a Service will reduce the barriers to entry for organisations looking to adopt this technology. An open and accessible platform can deliver equal opportunities for niche specialised applications, significant technology projects and everything in between.

How DLT as a Service works

The three main elements of an inclusive DLT as a Service solution include:

- The ledger and associated infrastructure. This includes the databases – which write, hold and save transactions – and the immutability and synchronisation layers.

- The customer nodes and access into the provider’s ecosystem. This includes secure networks and connectivity. It can solve many of the connectivity issues that are pain points for numerous organisations, packaging sophisticated technology into a simple, turnkey solution.

- The common libraries, applications, data rights and useful tools that an organisation can access, making it easier to on-board users and ensure applications are activated quickly.

Once an organisation’s specific application is built on a DLT as a Service platform, all transactions and workflows immediately become trackable, traceable and visible.

Benefits of DLT as a Service

The upsides of plugging into a comprehensive and proven DLT as a Service offering is clear-cut. Without the need to invest in building and operating this technology from scratch, organisations can:

- Increase speed to market

- Reduce the initial and ongoing cost of setting up

- Start small and scale up

By accessing DLT as a Service, organisations can model their compliance issues, risk issues and privacy issues into a single, smart-contract workflow.

Applications that utilise DLT may also offer greater operational efficiency and minimise errors associated with manual handling. The time taken up with back office reconciliation processes in many industries today – and especially the financial services sector – is often excessive and error prone. A huge amount of the paperwork associated with these processes can be automated through DLT, reducing and often eliminating the errors and inefficiencies that regularly accompany manual processing, along with the associated costs and risks.

Assessing DLT as a Service providers

When organisations are considering engagement with a DLT as a Service provider, credibility and trust are key considerations. Does the provider have a proven record in managing technology and platforms? Which 3rd parties are involved in delivering the solution and are they credible?

Organisations should ensure the smart-contract protocol used by the provider works on other platforms as well. That way, if the organisation is dissatisfied with the solution, it can take its application and re-deploy it on another platform or even internationally without having to re-platform or recode it. A number of DLT solutions providers and enterprises use Digital Asset’s Daml smart-contract language, which is interoperable with a range of ledgers across the market. Digital Asset is backed by 20 strategic investors, including leading financial and technology companies that are uniquely positioned to help drive adoption on a global scale.

A provider should be able to provide sufficient DLT infrastructure, data hosting, ledger services and support, so their customers don’t need to run and support their own environment. End user connectivity should be frictionless and offer the ability for applications to interconnect with each other for additional innovation and collaborative opportunities.

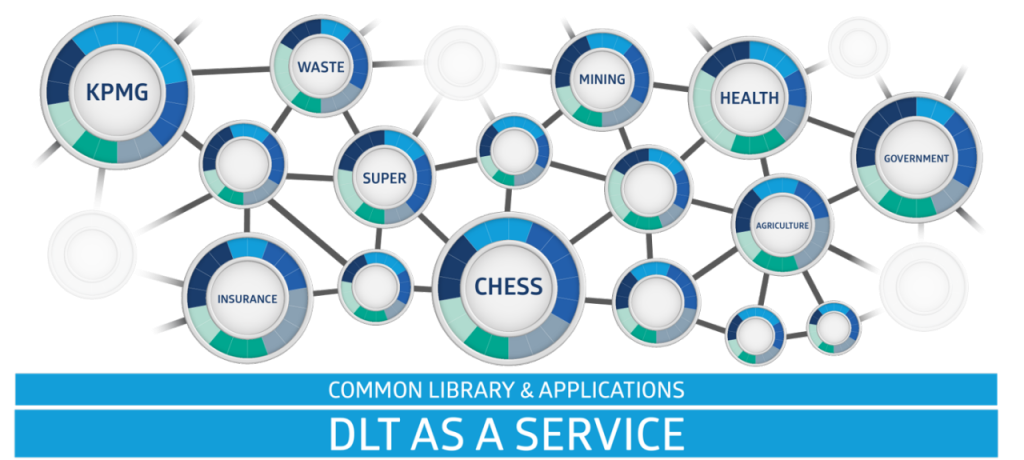

Organisations should also assess the quality of the provider’s ecosystem, and whether that ecosystem includes the number and quality of organisations and resources with which they can create synergies and value, resulting in a more dynamic environment for the development of their applications and business.

How the ASX developed its DLT as a Service offering

Over the past decade, ASX has built the Australian Liquidity Centre, a data centre housing ASX platforms and ASX Net as a vehicle to connect to our customers. The connectivity capacity of each was then opened up to financial institutions and their counterparties, building a high-quality ecosystem including listed companies, banks, brokers, insurance companies, superannuation funds, custodians and government agencies.

Similarly, the ASX has recently launched its own DLT technology, Synfini, powered by VMware Blockchain and Daml. Built initially to underpin the upgrade of ASX’s Clearing House Electronic Subregister System (CHESS), Synfini along with the ASX connectivity ecosystem, is now available for organisations to access in the form of DLT as a Service.

We are allowing other organisations to participate and write applications in the same protocols we write in, using the same ledger technology we use, to rectify business inefficiencies, innovate new business processes, eliminate paper-based reconciliation issues, and address a range of other business challenges.

Synfini has been chosen by KPMG, which is creating and operating the NSW Government’s Building Assurance Solution, as the platform to host its application. The KPMG application will provide a Trustworthy Index for buildings based on the source and quality of the materials and contractors used in its construction. This will enable interested parties to distinguish between compliant, resilient buildings and non-compliant, problematic buildings.

Other early adopters include Broadridge, which is developing an application that automates and eliminates paper for off-market transfers in the equities market; and Boulevard, which is building an ownership register for private companies. DigitalX will host their Drawbridge app on Synfini, a regtech application that helps companies reduce employee and director securities trading risks by automating the approval process.

Many of these projects have the potential to involve additional entities and expand to create even bigger ecosystems of collaboration and innovation.

Why ASX Synfini is a game changer

More than the productivity, efficiency, reliability and risk reduction that come part and parcel of DLT technology, Synfini is an enterprise grade DLT as a Service offering. Leveraging ASX’s strengths in managing key infrastructure, this platform will host one of the world’s largest applications of DLT – CHESS.

As the next-generation transaction synchronising technology, Synfini is open to all industries and offers:

- All the infrastructure, platform and software services required to build a DLT application enabling organisations to start their DLT journey quickly and cost-effectively. Including Daml platform and smart contract creation capability and VMware Blockchain.

- An ecosystem that comprises a potential audience of approximately 4,000 ASX customers for greater collaboration, value and impact.

- World class security from one of Australia’s most trusted market operators.

- Daml protocol, that can be used globally and within any country on different platforms.

How to get started

We suggest that users begin with a modest, easy-to-understand and easy-to-validate project.

It is important to have a flexible approach and be able to pivot after a project has been launched. Some applications may begin by solving one problem and may then reveal a much bigger opportunity.

Read more about ASX Synfini or contact us to speak with an expert in our team.

You will learn about our ecosystem and how to start building your application. You’ll also have the opportunity to see use cases of customers we are working with, and can even trial Synfini by building an application in our sandbox!

Paul Stonham

General Manager – DLT Solutions