First, a Brief History

What was the problem(s) that Vitalik Buterin was looking to solve?

Bitcoin provided a solution to the double-spend problem of creating digital cash by using proof-of-work mining to both maintain the state of the ledger and allow open participation in the network based on computing power. By assigning value to these digitally scarce coins the ledger can be used as a monetary system. This works great for money but comes up short when using Bitcoin’s scripting language to make simple extensions such as a decentralized exchange — how to determine the NZD/BTC rate? or how to do some arbitrary calculation, e.g. what is the probability that your game character encounters a villan?

While writing for Bitcoin Weekly and co-founding Bitcoin Magazine, Vitalik saw the limitations in Bitcoin as an opportunity to create a new blockchain from scratch that can allow developers to build general applications. The first feature to include in this new blockchain was Turing completness. In computer programming this means it is possible to have loops in the code which would be necessary, for example, for calculating a probability or the value of π. Bicoin’s script language is not considered Turing complete because it is stack-based and therefore anything that is needed by the program must be loaded onto the stack. (Also, by definition stacks cannot loop.)

The second feature was to use an account-based system. The benefit of this style is that each account (address) has a balance and the option of some code and storage. (This is in contrast to Bitcoin that uses a UTXO model I won’t detail here but basically can only keep track of coins and not any additional data or code.)

Summarized in the whitepaper, Ethereum is:

a blockchain with a built-in Turing-complete programming language, allowing anyone to write smart contracts and decentralized applications where they can create their own arbitrary rules for ownership, transaction formats and state transition functions.

The whitepaper for Ethereum was published online in 2013 and a year later a formal specification was written by Gavin Wood and the project raised funds through their initial coin offering. This was followed by the network launch in 2015.

Initial Coin Offering

In order to fund their new proposed blockchain network, the founders embarked on a unique fundraising scheme that laid down the template for future crowdfunding sales. An initial coin offering (ICO) seeks to bootstrap user adoption and funding by combining the style of an initial public offering (IPO) with a crowd fund model. A marked difference from the IPO model is that the token sale was open to anyone without geographic or regulatory restriction. All users had to do to participate was deposit bitcoin and receive ether tokens that represent their stake in the new network. The token sale was successful resulting in more than 50 million ether (the native currency of ethereum) being sold. Investors were aware of the token distribution from the beginning which included 9.9% of the tokens reserved for the founders (to fund development, salaries, bug bounties, etc.) and another 9.9% for a foundation that was set up to guide the long term mission of the network. These tokens didn’t have to be purchased in a traditional sense; a practice now known as pre-mining.

ICO Boom Times

The success of Ethereum’s ICO and its smart contract capability combined with its open source code made it an ideal model for other founders to fund their projects. A new project could easily copy and modify smart contract code and host their own ICO and issue their own new ERC-20 tokens. (ERC-20 refers to the token standard that most coins that run on Ethereum use.) 2017–2018 was a boom period for ICOs with many projects and tokens launching. Unfortunately many of them had questionable products and practices or were outright scams and because there was no regulation in crypto (as there is for an IPO), there was no recourse for those that invested and lost their money (this author included ?).

Smart Contracts

The term smart contract refers to some executable code that lives on the blockchain. This code may be a snippet, small or large, it may be straightforward or complex, it may contain bugs, not compile, it may never even be executed. Ethereum allows for code to be stored on the blockchain in contracts which have a callable address that looks just like a user’s address. All of these bits of code are generically called smart contracts. Pedants will like to tell you that they are not smart nor are they contractual and they might be right in a traditional sense, however, the term has come to be redefined in a blockchain context.

Earlier we mentioned that Ethereum is turing-complete, and here is where that comes in. A developer can write a program, say to issue crop insurance based on weather data, and store this program in a smart contract on the blockchain. As the blockchain is immutable this code will live there forever, it is also visible and thus can be easily verified or audited. The only limits to the applications that can be deployed on Ethereum come from the creativity & skill of the developer, and the amount of computation that program needs to do.

Computation occurs in the EVM (Ethereum virtual machine) and we will be light on details, but because its a blockchain, all the nodes need to have a copy of the data and verify any updates. This includes running all smart contracts and doing any calculation. A scenario could arise, either accidentally or maliciously, to halt the network by deploying a contract with an infinite loop:

int i=1

while i>0

i=i+1

The simple code above continually updates the counter because the stop condition of i being less than or equal to 0 is never met. To avoid this scenario all computation in the EVM needs gas. As a contract is executed gas is consumed and if the contract runs out of the gas then the update fails. All gas is paid in ether (ETH) and goes to the nodes (miners) that perform the calculations. A follow up question is what if I am wealthy and have enough gas to spam the network in this manner? To prevent this there is a gas limit on all transactions that is calculated based on how busy the network is.

The recent London upgrade to Ethereum changed the way that gas is distributed. Previously the miner would be compensated by receiving the entire gas fee in the transaction. Now, part of this fee is burned, and the miner gets the remainder. Burning some ETH reduces the overall issuance. More in the section on Proof-of-Work.

dapps

Decentralised applications, or dapps just refer to smart contracts that are executed on a blockchain. When combined with a frontend these dapps can appear just like any other web application with the key difference being that that code and/or user data is stored on the blockchain.

The most used dapps on Ethereum in 2021:

| App | Category | Users (k/30 days) |

|---|---|---|

| Uniswap | Decentralised Exchange | 520 |

| OpenSea | NFT Marketplace | 304 |

| MetaMask Swap | Decentralised Exchange | 166 |

| Polygon Bridge | Bridge | 114 |

| Sushi | Decentralised Finance | 98 |

Other categories of dapps that are popular are gaming and gambling although the last few years have been dominated by DeFi (decentralised finance) and 2021 saw breakout growth in NFTs (Non-fungible tokens) art & collectibles.

Stablecoins

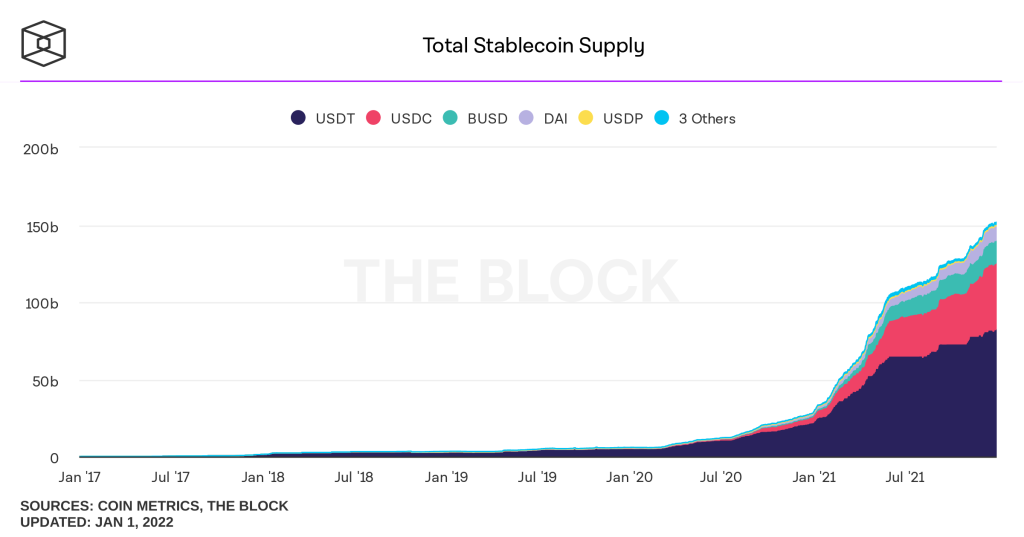

Although not listed in the chart above, stable-value currencies were originally categorized as applications that can run on Ethereum. Now called stablecoins, it is hard to ignore their growth and popularity when looking at total value. The idea behind them is that to avoid the volatility present in the crypto markets, rather than using ETH there is the option to use a crypto token pegged to a common currency like the $USD. If you convert some $NZD to Tether today, then you can rely on the value being relatively stable to use it in the future. Some of the stablecoins that exist on Ethereum are Tether USDT, USDC, and DAI. Both Tether and USDC are issued privately, whereas DAI is a Decentralized Autonomous Organization (DAO) and maintains a US dollar peg.

Chart from TheBlock showing growth in stablecoins over the past four years. The total value of stablecoins rose in 2021 from ~$28B to $150B. Note that this chart includes other blockchains, not just Ethereum.

I thought Ethereum was Proof-of-Stake?

Maintaining the database of accounts and smart contracts is done by the consensus algorithm and is a key component of any blockchain and often the first point of difference between blockchains. Bitcoin uses proof-of-work and relies on miners running purpose-built hardware to process transactions, and package and publish blocks. The incentive mechanism is a lottery based on the SHA256 (secure hash algorithm) result; when miners are lucky enough to find a winning hash they can publish a block and earn a reward.

The downside to Bitcoin’s mining algorithm is that it is suceptible to hardware optimisation in the form of ASICs (application-specific integrated circuits) that can be manufactured purely for mining purposes and are otherwise superfluous. Ethereum’s primary goal was to alleviate this by choosing an algorithm that required less pure processing power and relied more on general-purpose hardware like memory (RAM). The algorithm is called ethash and requires random read access to a 1GB dataset making it suitable for PC graphics cards to be used as miners. As in Bitcoin, miners are incentivised by a block reward that is currently 2 ETH per block. In summary Ethereum is presently a proof-of-work blockchain that uses GPU miners.

Where does proof-of-stake (PoS) come in?

It has always the ethos of the Ethereum community to transition the network to a fully stake-based validation mechanism and remove the need for expensive customized hardware. In a PoS system consensus is handled by validators that maintain skin in the game by contributing a stake in ether and are rewarded in a similar fashion to miners. A validator’s rewards are proportional to their stake in the system.

Eth2 is the name of the upgrade1 which has been split into many sub phases. Presently the network is in the final stages of the upgrade and the merge may? happen in 2022.

What did we miss?

There are many topics not discussed here (trying to keep this as an overview) and so I encourage you, dear reader, to dig deeper on the following:

- Scaling & Eth2 including sharding and rollups, zero-knowledge proofs, and the difficulty bomb

- The DAO hack was an important event in Ethereum’s history. There was a bug, and a lot of money was lost, but then the immutable blockchain was rolled back, the community split, now there still exists Ethereum Classic (ETC) and an ongoing question over the decentralised nature of Ethereum.

- Layer 1’s versus Layer 2’s: for example Bitcoin and Ethereum are considered base layer or layer 1 blockchains. Layer 2 blockchains look to extend the base layer and improve performance. Presently Polygon, Optimism, and Arbitrum are extending and improving the performance and reducing fees. You can think of this business model as having some of the (expensive) calculation being outsourced to a L2 which then reports back to the base layer.

- Questions of Tokenomics: What is the total supply of ETH? Is ETH money?

Further Reading – the very short list

- The Whitepaper by Vitalik Buterin

- The Yellowpaper by Gavin Wood, & pdf

- Extensive list of learning resources

About the Author

Jeff is a Senior Lecturer in Blockchain & Cryptocurrencies at AUT and an Executive Council member of BlockchainNZ. He can be found tweeting about crypto at @japple.

Next

- ? DeFi